Motorcycle insurance is an important type of insurance to protect the property and health of the driver and other road users around. If you are an expat, you need to learn more about this type of insurance and how it works. In this article, let’s find out details about motorbike insurance in Vietnam with Vietnam Teaching Jobs (VTJ), along with its benefits and things to keep in mind when buying one.

>>>Read more: Health insurance in Vietnam and what you should know

What is motorcycle insurance in Vietnam?

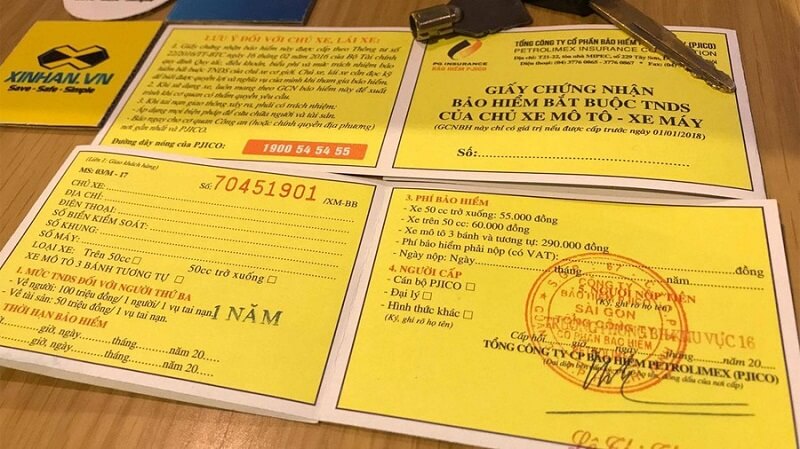

When buying motorcycle insurance, the motorcycle owner will pay a premium to the insurance company

Motorcycle insurance is a form of insurance to protect the owner of a motorbike or the driver of a motorbike against risks that may occur during the use of a motorbike. This includes traffic accidents, vehicle theft, physical loss or accidental injury…

When buying motorcycle insurance, the motorcycle owner will pay a premium to the insurance company. This company will guarantee to compensate the motorcycle owner if the risks specified in the insurance policy occur. Depending on the terms and conditions of the insurance policy, the level of protection and the cost of coverage may also vary.

This is considered as one of the mandatory documents for vehicle owners to operate their vehicles when participating in traffic.

>>>Read more: Social Insurance Regime For Foreign Workers In Vietnam

Some popular types of motorcycle insurance in Vietnam

According to the provisions of Clause 3, Article 4 of Decree No. 03/2021/ND-CP, there are currently 2 types of motorcycle insurance:

Compulsory civil liability insurance (CCLI) for motorbikes:

In the event of an accident, CCLI insurance will compensate the accident victim (not the car owner)

This is compulsory insurance that motor vehicle owners must have when participating in traffic according to the provisions of the law. In the event of an accident, CCLI insurance will compensate the accident victim (not the car owner). The accident victim will be compensated for the damage caused by the motorcycle owner, this amount is paid by insurance. The insured will not need to compensate for the damage caused by the accident on their own.

This is third-party insurance and in general covers:

- 100 million VND per person per case in relation to people

- 50 million VND per person per case for assets

>>>Read more: Common types of taxes in Vietnam that an expat should know

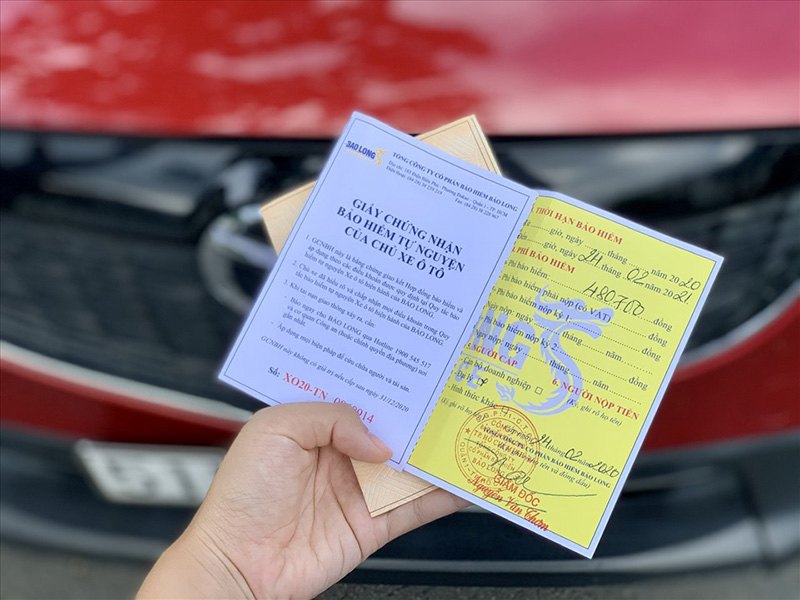

Voluntary motorcycle insurance:

Voluntary motorcycle insurance for vehicle owners

This type of insurance is optional. Motorcyclists can buy more to enjoy financial benefits (for both vehicle owners and their companions) in the event of an accident, fire or theft. However, depending on the type of contract that the car owner buys with the insurer, the scope of liability and compensation will be different.

>>>Read more: HOW TO KEEP SAFE ON YOUR MOTORBIKE IN VIETNAM

How much does car insurance cost?

How much does car insurance cost?

Circular 04/2021/TT-BTC regulating civil liability insurance of road motor vehicle owners. Accordingly, the price of motorcycle insurance will depend on the year of manufacture of the vehicle and the price is calculated as a percentage (%) of the vehicle’s value.

Specifically, the price of motorbike insurance in Vietnam is regulated as follows:

- For vehicles with a cylinder capacity of less than 50cc:

- Vehicles manufactured in 2019 or earlier: 2.5% of vehicle value.

- Vehicles manufactured from 2020 onwards: 1.5% of vehicle value.

- For vehicles with cylinder capacity from 50cc to under 175cc:

- Vehicles manufactured in 2019 or earlier: 1.5% of vehicle value.

- Vehicles manufactured from 2020 onwards: 0.75% of vehicle value.

- For vehicles with a cylinder capacity of 175cc or more:

- Vehicles manufactured in 2019 or earlier: 1% of vehicle value.

- Vehicles manufactured from 2020 onwards: 0.5% of vehicle value.

For example: If the value of a 50cc motorcycle manufactured in 2022 is VND 20 million, the civil liability insurance price of this bike will be VND 20 million x 1.5% = VND 300 thousand.

>>>Read more: Getting a driving licence in Vietnam – How do I do it?

Where to buy reputable motorbike insurance in Vietnam?

Buying reputable motorcycle insurance depends on many factors such as the reliability of the insurance company, the level of protection, and the price. Here are some reputable motorcycle insurance addresses that you can refer to:

- Liberty Insurance: is one of the popular motorcycle insurance companies in Vietnam, providing many insurance packages with reasonable fees, ensuring customers are fully protected.

- PVI Insurance: is a large insurance company in Vietnam, providing a variety of motorcycle insurance packages with competitive fees, ensuring comprehensive protection for customers’ motorbikes.

- Bao Viet Insurance: provides many motorbike insurance packages with reasonable fees, ensuring comprehensive protection for customers’ motorbikes.

- PTI Insurance: is a reputable insurance company in Vietnam, offering a variety of motorbike insurance packages with competitive premiums. They will ensure comprehensive protection for customers’ motorcycles.

Those are some reputable motorcycle insurance addresses that you can refer to. However, before deciding to buy insurance, you should learn carefully about insurance policies, regulations, conditions and prices to be able to choose the right insurance package for your needs.

How to look up motorbike insurance in Vietnam online?

There are 2 ways for you to actively look up motorcycle insurance online without going to insurance sales establishments.

Look up electronic motorcycle insurance via the QR code

Step 1: You open the Camera application / take a photo on your phone, and put the QR Code area on the Insurance Certificate (Paper / Electronic only) into the display area of the camera.

Step 2: Your phone will immediately receive a Lookup link notification. Next, you click on that link will display all the detailed information about the type of motorbike insurance purchased.

In case your phone does not support scanning QR Code via camera, you can use other applications that support QR Code scannings such as Zalo, and QR Code Scanner …

Look up motorcycle insurance in Vietnam by going on the website of the insurance company

The second way is that you can go directly to the website of the company that has sold you motorbike insurance in Vietnam to conduct a search:

Normally, you need to fill in the following necessary information to be able to look up: lookup code, insurance certificate number, license plate, ID/CCCD of the insurance buyer…

After entering all the information, the return result is a detailed information file. It includes the type of motorcycle insurance you have purchased for the vehicle you are using, beneficiary information, and information related to compensation when something goes wrong.

In addition, the contract and certificate of compulsory civil liability insurance for motorbikes and motorbikes will be sent directly to the phone number or email registered by the customer on the system. This will help to store information, easier to query when needed.

>>>Read more: You can travel by limousine in Vietnam and here’s how to do it

How much is the penalty for not having motorbike insurance?

How much is the penalty for not having motorbike insurance?

For compulsory motorbike insurance in Vietnam

According to point a, clause 2, Article 21 of Decree 100/2019/ND-CP (amended by clause 11 Article 2 of Decree 123/2021/ND-CP), if there is no motor vehicle civil liability insurance ( including motorbikes), you will be fined from 100,000 VND to 200,000 VND.

However, if the car owner intentionally does not buy insurance, or buys insurance but does not pay the fee, he will be fined from 200,000 VND to 400,000 VND and may be deprived of the right to use the driver’s license from 1 to 3 months.

Note that the above fines are the minimum amount set by law and can be increased depending on the status of the violation as well as depending on the regulations of each locality.

For voluntary motorcycle insurance

Since this is a form of insurance purchased additionally to enhance benefits for motor vehicle owners and rear passengers, they are not mandatory. Therefore, when participating in driving a motor vehicle, without this type of insurance, the car owner will not be administratively handled.

>>>Read more: 8 Most Frequent Mistakes When Driving in Vietnam

Above is some information about motorbike insurance in Vietnam in 2024. You can refer to it so that you can buy or look up electronic motorcycle insurance if needed.

Are you facing difficulties in finding and securing teaching positions in Vietnam? Are visa procedures causing you trouble? Feeling overwhelmed and directionless upon your arrival in Vietnam for teaching assignments? Don’t worry, VTJ’s English Teaching Placement in Vietnam (EPIV) Program 2024 provides comprehensive support to solve ALL the matters.

👉👉👉 Click HERE to request free consultation